The wage revision for five years will be effective November 2022, which means employees will receive arrears for the previous 12 months.While the package based on pay slip expenses for 2021-22 will be effective across all public sector banks, including SBI, several old generation private players also have salaries linked to the revised one.

The IBA has also asked the government to declare all Saturdays as bank holidays under the Negotiable Instruments Act, a demand that was forwarded by the banking lobby group several months ago but is pending with the Centre.

The new pay scales will be constructed after merging dearness allowance corresponding to 8,088 points (average index point as applicable for the quarter of July, August, and September 2021) to the basic pay as on October 31, 2022, and adding thereon a loading of 3%, amounting to Rs 1,795 crore.

The IBA will work out the distribution of the annual wage increase between workers and officers separately and proportionately based on the breakdown of establishment expenses for FY22.

The agreement also provides, as a one-time measure, a monthly ex-gratia amount along with pension by PSBs to pensioners and family pensioners who were drawing pension as of October 31, 2022. The applicability of the said ex-gratia for the retirees of the current settlement period is yet to be finalised.

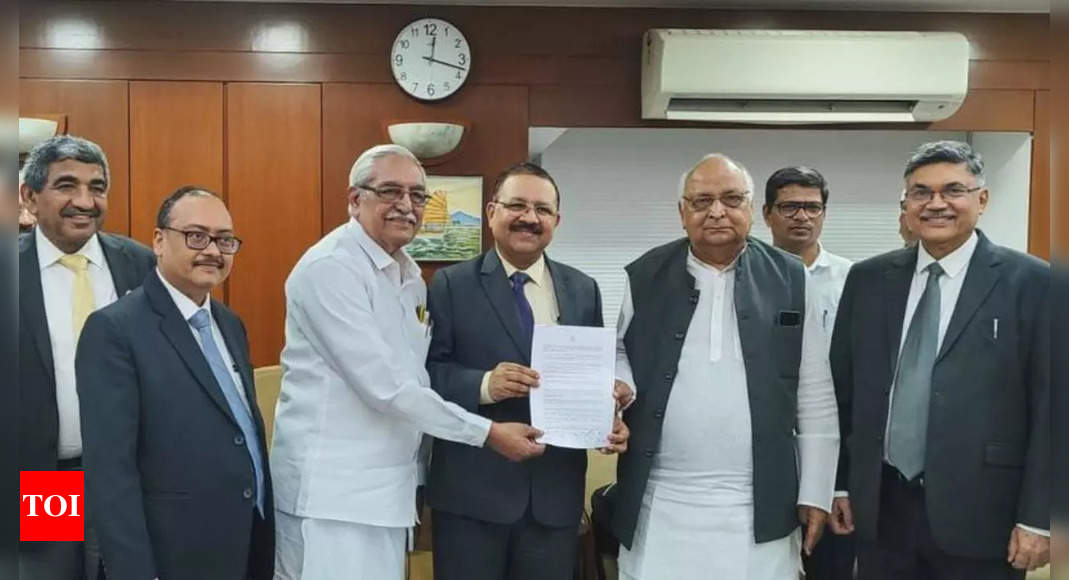

A final detailed bipartite settlement/joint note on the wage revision will be finalised within 180 days. The MoU, signed late Thursday, marks the 12th bipartite wage hike settlement between the bank’s association, the unions, and the officers’ association since the industry’s collective bargaining system started in 1966.

“The management and the unions/ associations representing the workmen, staff and officers mutually acknowledge the necessity for a robust banking system adaptive to the challenges facing the banking industry. There is a shared commitment to further improve productivity, efficiency, and responsiveness to the needs of customers and various stakeholders,” the MoU said.