• FBR chief cites ‘poor’ collection of farm income, services and property taxes

• PIA privatisation and transparency also comes under discussion

LAHORE: The provinces have little incentive to improve the collection of three major taxes as they continue to receive an adequate share from the federal government under the National Finance Commission (NFC) award, prominent officials and economic experts said on Sunday.

“The provinces are mainly collecting three major taxes — sales tax on services, agriculture income tax and property tax,” Federal Board of Revenue (FBR) Chairman Rashid Mahmood Langrial said, adding that they were performing “poorly” in all these areas.

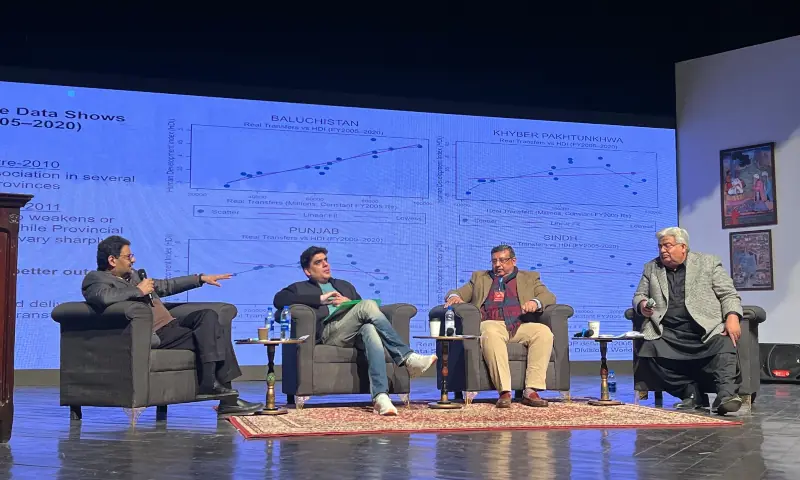

He was speaking at a session titled ‘NFC, Governance and the Crisis of Money’ on the concluding day of the ThinkFest event held here.

Former finance minister Miftah Ismail opened the session as moderator and informed the participants on the distribution of funds under the NFC award.

He said 57.5 per cent of the total federal government revenues were transferred to the provinces. In addition, the federation gives one per cent of revenues to Khyber Pakhtunkhwa for combating terrorism and also supports the Azad Kashmir and Gilgit-Baltistan governments financially.

He said sales tax on goods was still collected by the federation, while tax on services was the responsibility of the provinces.

FBR chief Langrial appreciated the provinces for improvements in governance, including cleanliness and other development initiatives.

However, he was critical of their performance in terms of tax collection.

“I will tell you the numbers. Of the total agriculture income tax base of Rs3.7 trillion, the provinces are collecting just Rs8.4 billion,” he said.

He said property tax collection by provinces stood at only 0.08 per cent of GDP in Pakistan, compared to 5pc in Malaysia, 3pc in Indonesia and 2pc in India.

He added that per capita property tax collection in Lahore was Rs623, against Rs1,276 in Chandigarh.

“In Karachi, the per capita tax collection amounts to just Rs111, whereas in Bangalore it stands at Rs11,233,” he said.

Mr Langrial said provinces needed to collect more taxes as their revenue gap was too much, while the federation should also minimise its expenses.

Economist Savail Hussain said transfers from the federation to provinces continued rising from 2001 to 2009, but outcomes in terms of the Human Development Index (HDI), except in Balochistan, remained below the mark.

“At present, we have a public finance crisis that can only be overcome if both the federation and provinces sit together and make the NFC performance-based,” he said.

Asad Sayeed, a member of the 2009 NFC, said all stakeholders had agreed to raise the tax-to-GDP ratio to 13.5pc by 2015, but the FBR had crossed only 10pc so far.

Privatisation

In another session, speakers discussed the government’s ongoing privatisation of state-owned enterprises. The session, titled ‘Privatisation: An Easier Route or Structural Change’, was moderated by Ms Rahat Kaunain Hassan.

The speakers included Privatisation Commission Chairman Muhammad Ali and Arif Habib Group CEO Nasim Beg, while former Privatisation Commission chairman Muhammad Zubair also spoke.

Mr Beg said the consortium that recently won the bidding for Pakistan International Airlines (PIA) would focus on reviving international operations and improving domestic services despite facing a massive competition.

PC Chairman Muhammad Ali dispelled the impression that valuable PIA land would be transferred to the bidder, saying only international and domestic offices would be taken over.

Mr Zubair asked why PIA was not privatised in 2023 and 2024 despite similar bid prices, and raised concerns over the recent appointment of a new chairman despite the privatisation process.

Published in Dawn, January 26th, 2026