Reality check: Just 4 out of 36 Shark Tank Pakistan deals actually materialize

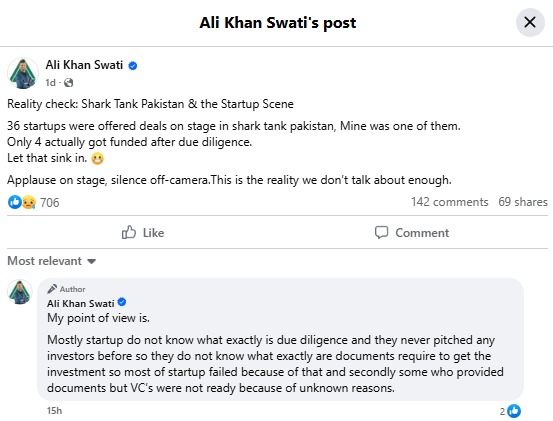

Ali Khan Swati, a participant on “Shark Tank Pakistan”, recently highlighted the stark gap between on-air applause and real-world outcomes. He revealed that out of the 36 startups that received investment offers on the show, only 4 secured funding after completing due diligence, exposing the challenges within Pakistan’s startup funding ecosystem.

Ali Khan Swati, who leads Layesha and Red Tale Studio and trains at the National Incubation Center, shared on Facebook how his experience revealed a harsh reality. Although his startup secured funding just 20 days after the episode aired, the investment came from other investors whose terms aligned better with his vision. Notably, the “Shark Tank” team never included him in their official due diligence process.

Swati pointed out that many startups, desperate for the promised investment, completed all the required steps, submitted extensive paperwork, and waited for months, only to walk away with nothing. “They applaud you on stage, then go silent off-camera. This is the reality we don’t talk about enough,” he remarked.

His post has sparked conversations about how Shark Tank Pakistan’s startup funding often appears more promising on television than it is in reality. With only 4 out of 36 investment offers making it past due diligence, the numbers reveal a sobering picture of the show’s actual deal conversion rate.

Pakistan’s Wider Startup Struggle:

Beyond the disappointment surrounding Shark Tank Pakistan’s startup funding, the country’s entire entrepreneurial ecosystem faces mounting pressure. A severe funding drought, driven by macroeconomic instability, soaring inflation, and the rupee’s sharp decline, has pushed both local and foreign investors away. Startups are also struggling with excessive red tape, a weak regulatory framework, and a shortage of skilled talent. The ongoing “venture winter” and a focus on rapid growth over sustainable profits have further deepened these challenges, making it increasingly difficult for new companies to secure early-stage funding and scale effectively.

Amid these challenges, a new show called “Bazaar” is set to launch in early 2026. ARY Digital Network and PakLaunch have joined forces to create Bazaar, aiming to provide early and growth-stage startups with not only national visibility but also direct access to funding, mentorship, and investors. The show will feature a panel of four investors or “gurus,” nine mentors, a live equity exchange, funding from an ARY–PakLaunch investment pool, and regulated public crowdfunding options. In a unique move, the show will also offer mentors a small equity stake in the businesses they support, incentivizing deeper and more meaningful guidance.

Whether Bazaar can genuinely address the deep-rooted challenges in Pakistan’s startup ecosystem remains uncertain. While the show promises exposure and access to capital, it must prove its ability to close funding gaps and promote sustainable business practices. Only time will reveal if it can help build a stronger, more resilient startup landscape in Pakistan.